The integration of advanced artificial intelligence into the tightly regulated world of financial operations represents a pivotal evolution, moving beyond simple automation to create a collaborative synergy between human expertise and machine efficiency. The use of advanced AI in financial operations represents a significant advancement in the banking sector. This review will explore the evolution of this technology through the lens of a specific implementation, detailing its key features, performance in real-world scenarios, and the impact it has had on core business functions. The purpose of this review is to provide a thorough understanding of how AI is currently being leveraged to augment human capabilities, its present effectiveness, and its potential for future development within highly regulated environments.

The Rise of AI in Core Banking Functions

The strategic adoption of sophisticated Large Language Models (LLMs) like Anthropic’s Claude marks a fundamental change in the financial services industry. The core principle driving this integration is not the replacement of human experts but their augmentation, empowering them to manage complex, data-intensive tasks with greater speed and precision. This technological shift addresses the persistent demand for improved operational efficiency, accuracy, and scalability, all while navigating the stringent regulatory landscape of modern banking.

This evolution signifies a move away from rudimentary task automation toward a more advanced form of judgment-based workflow enhancement. By handling the preliminary stages of data extraction and analysis, AI allows financial professionals to redirect their focus toward higher-value activities that require critical thinking and nuanced decision-making. The relevance of this approach lies in its ability to unlock new levels of productivity without compromising the rigorous standards of compliance and oversight that define the sector.

Key Technological Features and Implementation Models

Human in the Loop Software Development

A primary application of this new model is the integration of AI agents, such as a version of Claude paired with Cognition’s Devin, directly into the software development lifecycle. In this framework, human developers establish the project specifications and critical regulatory constraints. The AI agent then takes over the labor-intensive work of generating, testing, and refactoring code. This output is subsequently passed back to the developers for a final review and approval.

This collaborative process has demonstrated a marked increase in developer productivity, effectively accelerating the delivery of new software projects from conception to deployment. By offloading the more repetitive aspects of coding, the human-in-the-loop model frees up developers to concentrate on architectural design and complex problem-solving, thereby optimizing the entire development pipeline.

Automation of Document Intensive Workflows

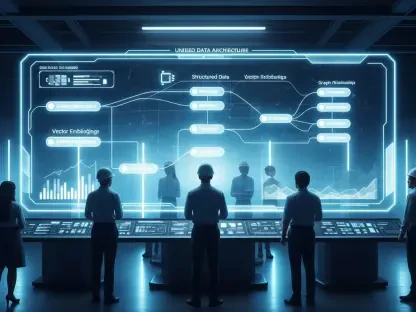

Another key feature is the automation of traditionally manual, judgment-based operational tasks, particularly in areas like trade accounting and client onboarding. AI systems are now deployed to review a wide array of documents, extract critical entities, analyze complex corporate ownership structures, and determine whether additional compliance checks are warranted. This capability has proven transformative for processes that were once significant operational bottlenecks.

Claude’s large context window and advanced instruction-following capabilities make it exceptionally effective at processing unstructured data from disparate sources, such as ledgers, passports, and corporate registrations. The system can swiftly identify and flag inconsistencies for human review, streamlining reconciliation and onboarding workflows. This reduces the manual burden on analysts and enhances the overall accuracy of these critical functions.

Emerging Trends in Human AI Collaboration

The latest trend in financial AI involves the formalization of a hybrid operational model that establishes a clear and deliberate division of labor between AI systems and human experts. This approach strategically positions AI as a “workflow layer” responsible for preliminary data extraction, comparison, and analysis. This allows the technology to handle the high-volume, repetitive aspects of a process efficiently.

Crucially, under this model, existing compliance and accounting platforms remain the official systems of record, ensuring continuity and regulatory adherence. Human analysts retain ultimate authority, stepping in to manage exceptions, resolve complex cases, and make critical final judgments. This balanced framework is rapidly becoming the key to unlocking substantial operational value while maintaining the unyielding standards required in regulated industries.

A Case Study in Financial Services Goldman Sachs

Goldman Sachs provides a prominent example of this technology in action. The institution strategically deployed AI to address identified bottlenecks in its core business functions. In software development, the goal was to accelerate project timelines. In operations, the implementation targeted high-volume, document-heavy processes in trade accounting and client onboarding, significantly reducing the manual effort required from analysts and streamlining the entire workflow from start to finish.

Addressing Challenges and Operational Risks

The primary challenge in deploying AI in finance is mitigating the risk of errors, or “hallucinations,” within a sector where accuracy is paramount. The technology addresses this through features designed to surface uncertainty and provide clear source attribution for all data points, creating a transparent audit trail. Furthermore, the human-in-the-loop framework serves as the ultimate safeguard, ensuring that human oversight is maintained for all critical decisions. This combined approach counters the risks while leveraging AI’s ability to detect subtle anomalies at a scale that humans might miss.

Future Outlook for AI Enhanced Operations

The future of AI in finance points toward a significant expansion of operational capacity and throughput without a proportional increase in human staffing. As the technology matures, financial institutions will be able to handle greater volumes of complex transactions and client-facing processes with increased speed and accuracy. The long-term impact will be a redefinition of roles, with human experts shifting their focus from routine data processing to higher-value strategic analysis and exception management, enabled by their AI counterparts.

Summary and Overall Assessment

AI-driven systems, when implemented with a clear strategic vision, are fundamentally transforming financial operations. The success of Anthropic’s Claude at Goldman Sachs illuminated a critical insight: the most effective model is a hybrid one that masterfully combines automated AI scrutiny with indispensable human judgment. This approach not only boosted efficiency and productivity but also upheld the rigorous standards of accuracy and compliance required in the financial industry. The technology’s performance demonstrated its readiness for complex operational tasks, with its future potential centered on creating more scalable and intelligent financial ecosystems.