In a significant move to redefine its digital economy, Hong Kong has initiated an ambitious strategy designed to weave artificial intelligence into the very fabric of its key industries, moving far beyond the traditional confines of finance. The Hong Kong Monetary Authority (HKMA) has officially launched “Fintech 2030,” a comprehensive five-year plan that marks the third phase of the city’s evolving fintech roadmap. Commencing this year, the initiative is squarely focused on championing the widespread adoption of advanced AI, with a particular emphasis on generative AI, to catalyze the next wave of digital financial innovation. At its core, the strategy is built on the principles of extensive cross-sector collaboration and the secure sharing of data, aiming to create a synergistic ecosystem where technology can solve complex, multi-industry challenges. This forward-looking agenda seeks not only to solidify Hong Kong’s position as a leading global financial hub but also to transform it into a trailblazer in applied AI across a diverse economic landscape.

A Unified Regulatory Framework for Innovation

A cornerstone of the Fintech 2030 initiative is the strategic expansion of the HKMA’s established AI sandbox. This move will transform the existing regulatory testing ground from a finance-centric facility into a comprehensive, multi-industry platform. The expanded sandbox is designed to provide a secure and meticulously regulated environment where companies from various sectors can converge to experiment with, develop, and refine new AI applications without immediate regulatory pressures. According to HKMA Chief Executive Eddie Yue, the primary objectives are to materially enhance corporate risk management protocols, significantly improve the precision and speed of fraud detection systems, and elevate the quality and personalization of customer service across the board. By inviting a wider range of industries to participate, the sandbox will foster the creation of novel solutions that leverage diverse operational perspectives, ultimately leading to more robust and resilient technological frameworks that benefit the entire economy, not just the banking sector.

To ensure the successful implementation of this expanded vision, the HKMA is proactively engaging in deep discussions with other principal financial regulators. This collaborative effort includes key bodies such as the Securities and Futures Commission (SFC) and the Insurance Authority, with the goal of fostering seamless inter-agency cooperation. Such alignment is critical for supporting the broad integration of AI, as innovative applications often blur the lines between traditional regulatory purviews. A unified front among regulators will create a clear, consistent, and predictable environment for businesses looking to innovate at the intersection of finance, insurance, and securities. This cooperative stance is intended to dismantle potential regulatory silos, prevent fragmentation, and encourage the development of ambitious, large-scale projects that can address systemic challenges. Ultimately, this coordinated regulatory support is fundamental to building a cohesive and dynamic innovation ecosystem capable of supporting the far-reaching goals of the Fintech 2030 strategy.

The Power of Cross-Sector Data Synergies

The Fintech 2030 strategy places a heavy emphasis on the critical importance of cross-sector data collaboration as the primary fuel for training next-generation AI. Chief Executive Eddie Yue has articulated that the fusion of diverse datasets from disparate industries is an absolute necessity for developing artificial intelligence models that are not only more powerful but also more accurate and contextually aware. When AI systems are trained on a narrow set of data, they are prone to biases and limited in their predictive capabilities. However, by combining financial transaction histories with information from telecommunications, retail, or logistics, developers can create AI that understands complex patterns and relationships that would otherwise remain hidden. This approach moves beyond simple data access, advocating for a sophisticated fusion of information to unlock unprecedented insights into everything from consumer behavior and credit risk to supply chain vulnerabilities and macroeconomic trends, thereby enabling the creation of truly transformative AI-driven services.

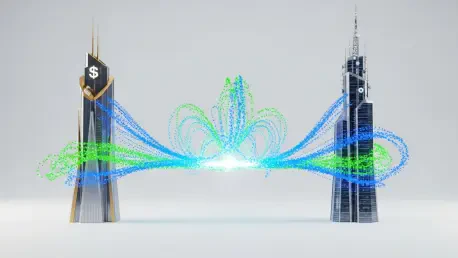

Putting this vision into practice, a tangible pilot project is already demonstrating the immense potential of this collaborative approach. The project involves a partnership between a major local bank and a leading telecommunications firm, who are working together to develop highly advanced AI-powered tools for combating financial fraud. This early-stage cooperation serves as a powerful proof-of-concept for the Fintech 2030 framework, showcasing how combining varied data streams can yield innovative and effective solutions. For instance, the telecommunications company can provide anonymized data related to potential SIM card swaps, unusual roaming activity, or other network-based red flags. When this information is correlated in real-time with the bank’s transactional data, the resulting AI model can identify sophisticated fraud schemes with a level of speed and accuracy that neither organization could achieve independently. This pioneering effort exemplifies the practical application of the strategy, highlighting how breaking down industry silos can lead to tangible public benefits.

Charting a New Course for Digital Finance

The launch of the Fintech 2030 strategy marked a pivotal moment for Hong Kong’s technological ambitions, establishing a clear and actionable blueprint for its evolution into a globally recognized hub for applied artificial intelligence. The initiative moved beyond theoretical discussions and laid the practical groundwork for a future where the city’s economic strength was defined not by its individual industries but by the innovative connections between them. This strategic shift from a sector-specific focus to a holistic, ecosystem-wide approach signaled a new era of collaborative innovation. The successful realization of this vision hinged on navigating the intricate web of data privacy regulations, establishing universally accepted and secure protocols for data sharing, and actively cultivating a culture of trust among sectors that had historically operated as competitors. The initial pilot project between the banking and telecommunications sectors provided an essential early blueprint, demonstrating a viable path for overcoming these significant challenges and setting a compelling precedent for the more complex and ambitious cross-sector integrations that were planned to follow.