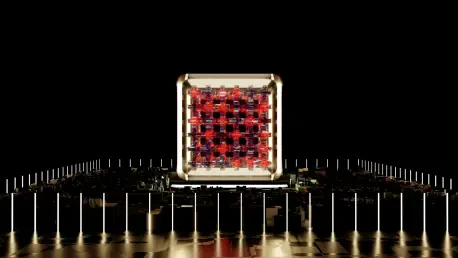

In the ever-evolving realm of artificial intelligence, a seismic shift is brewing as Alphabet Inc.’s Google emerges as a formidable challenger to Nvidia Corp.’s long-standing reign in the AI chip market, a sector valued by analysts at a staggering $900 billion. This competitive landscape is being reshaped by Google’s Tensor Processing Units (TPUs), custom-engineered chips designed specifically for AI workloads, which are positioning themselves as a viable alternative to Nvidia’s widely adopted graphics processing units (GPUs). The stakes are high, with the potential to redefine industry leadership and unlock significant value for Google. As demand for efficient AI infrastructure skyrockets across various sectors, the battle between these tech giants raises critical questions about innovation, cost, and market dynamics. This development signals a pivotal moment where specialized hardware could alter the balance of power in a field that drives everything from healthcare to autonomous systems.

The Rise of Specialized AI Hardware

Efficiency and Cost Advantages of TPUs

Google’s TPUs are gaining traction due to their remarkable efficiency in handling machine learning tasks, offering a distinct edge over Nvidia’s more general-purpose GPUs. These chips are tailored for specific AI functions, resulting in lower power consumption and faster processing speeds, which are crucial for companies managing massive data workloads. This efficiency is particularly appealing to frontier AI labs and startups grappling with Nvidia’s high costs and supply constraints. As industries increasingly prioritize sustainable and cost-effective solutions, Google’s technology addresses a pressing need for alternatives that don’t compromise on performance. The growing interest in TPUs reflects a broader shift toward hardware that can optimize energy use while delivering robust computational power, potentially eroding Nvidia’s market share over time. Analysts note that this trend could push other players to rethink their strategies in a market hungry for innovation.

Strategic Integration with Cloud Services

Another key factor bolstering Google’s position is the seamless integration of TPUs with its cloud services, creating an accessible and attractive ecosystem for clients seeking alternatives to Nvidia’s pricey offerings. This strategic alignment allows businesses to tap into advanced AI capabilities without the burden of hefty upfront investments in hardware. Google Cloud’s focus on AI workloads is projected to generate substantial revenue, highlighting the commercial viability of this approach. By embedding TPUs into its broader service framework, Google not only enhances user experience but also builds a sticky platform that encourages long-term client loyalty. This move directly challenges Nvidia’s dominance by offering a more integrated and cost-competitive solution, appealing to a diverse range of enterprises looking to scale their AI operations efficiently. The accessibility of TPUs through cloud infrastructure underscores Google’s intent to democratize high-performance computing.

Market Dynamics and Competitive Pressures

Industry Trends Toward Diversification

The AI chip market is witnessing a significant trend toward diversification, as tech giants like Microsoft and Meta explore in-house solutions or forge partnerships with other chipmakers such as Broadcom, which recently aligned with OpenAI. This shift is driven by a desire to reduce dependency on a single supplier like Nvidia, whose GPUs, while powerful, come with vulnerabilities tied to geopolitical tensions over chip exports and high energy demands. Google is capitalizing on this momentum by expanding TPU availability through third-party data centers, directly competing with Nvidia’s rental networks. This aggressive outreach, including targeting some of Nvidia’s former clients, signals a bold push to reshape market dynamics. The industry’s move away from over-reliance on one player suggests a future where multiple hardware options could lower costs and spur innovation across fields like autonomous systems and healthcare.

Financial Implications and Investor Sentiment

Financial markets are also reflecting the intensifying rivalry between Google and Nvidia, with Alphabet’s stock experiencing a significant rally among megacap tech firms, while Nvidia’s shares face periodic declines. This divergence hints at growing investor confidence in Google’s AI capabilities, further supported by favorable regulatory outcomes in antitrust matters. Speculation abounds that spinning off the TPU business, possibly merging it with Google’s DeepMind AI division, could create an entity with a valuation rivaling major industry players. Such a strategic move would not only unlock substantial shareholder value but also heighten pressure on Nvidia to accelerate innovation. Meanwhile, Nvidia’s entrenched software ecosystem remains a formidable barrier, sustaining investor focus on its earnings. Yet, Google’s emerging role introduces a counterbalance that could stabilize pricing and enhance resilience within the AI hardware sector over the coming years.

Looking Ahead: Shaping the Future of AI Hardware

Reflecting on a Shifting Landscape

Looking back, the competition between Google’s TPUs and Nvidia’s GPUs marked a defining chapter in the AI chip industry, where strategic positioning and technological innovation collided to challenge established norms. Google’s quiet yet determined advancements with specialized hardware stood out as a counterpoint to Nvidia’s meteoric ascent, revealing vulnerabilities in a market once thought unassailable. The industry’s response, characterized by a push for diversification and efficiency, highlighted a collective recognition that no single player could dominate indefinitely. Financial markets mirrored this uncertainty, with fluctuating investor sentiment underscoring the fluid nature of tech leadership. As TPUs gained ground through integration and accessibility, they reshaped perceptions of value and performance in AI infrastructure, setting the stage for a more competitive and dynamic ecosystem.

Next Steps for Industry and Investors

Moving forward, stakeholders must closely monitor how Google expands its TPU footprint, particularly through partnerships and third-party integrations, to assess the true scale of its challenge to Nvidia. Companies seeking AI solutions should evaluate the long-term benefits of adopting specialized hardware versus sticking with established ecosystems, balancing cost against compatibility risks. For investors, diversifying portfolios to include emerging players in the AI chip space could mitigate exposure to market volatility tied to a single dominant firm. Additionally, keeping an eye on regulatory developments and geopolitical factors will be crucial, as these elements could further influence supply chains and innovation timelines. The path ahead demands a proactive approach, where adaptability and foresight will determine who thrives in an industry poised for transformation. Encouraging competition through varied hardware standards may ultimately drive broader access to cutting-edge technology, benefiting society as a whole.