In recent years, the landscape of artificial intelligence has dramatically transformed the technological world, influencing sectors far beyond its initial realms. This transformation has spurred a remarkable surge in investments towards AI infrastructure as industries strive to adapt and grow amidst this wave of innovation. With AI being positioned as a central force driving future global developments, organizations are increasingly acknowledging the need to erect strong foundations upon which AI technologies can further expand and flourish. This necessity is prompting significant financial investment into the sectors critical for AI infrastructure development, such as data centers, energy suppliers, and materials producers.

The Strategic Importance of AI Infrastructure

Identifying Key Sectors for AI Advancement

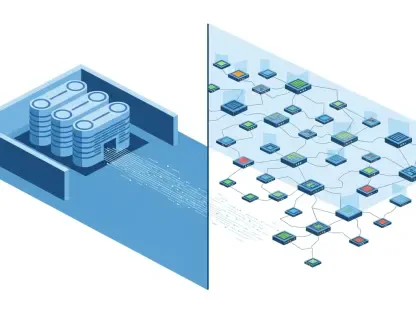

The burgeoning demand for AI infrastructure is primarily fueled by its vital role in supporting various industries that harness AI for enhanced operations and efficiency. Noteworthy sectors like data centers, energy grids, and materials production form the backbone facilitating the deployment and scaling of AI technologies. Data centers are seeing a substantial expansion as they offer the computational power required for AI applications, evidencing predictions of their value growth to $4 trillion within the foreseeable future. Furthermore, energy suppliers are increasingly integral, as AI demands power-intensive operations, contributing to increased electricity consumption. Critics and industry experts emphasize the importance of these sectors in sustaining AI growth, highlighting the necessity for continued investment and development.

Materials Drive the Innovation

Materials such as copper and uranium are gaining prominence due to their essential functions within the AI infrastructure ecosystem. Copper is indispensable in electrical wiring and manufacturing processes that support advanced energy systems, while uranium’s critical role lies in energy generation through nuclear power, aiding cooling and computational efficiency. As tech-driven demands escalate, these materials are increasingly pivotal to ensuring seamless operation and systematic innovation in AI frameworks. Investors are therefore advised to explore possibilities beyond typical tech stocks, as these exposure areas promise lucrative returns amidst the advancing AI landscape. The focus rests on encouraging diversified investments supporting infrastructure that undergoes transformative repair and expansion, ensuring robustness to fuel AI developments.

Implications of AI-Driven Investments

The Economic Ripple Effect

With AI infrastructure investments surpassing expectations in recent periods, economic implications are becoming apparent worldwide. Predictions forecast a 25-fold increase in the AI market, signaling unprecedented growth potential for involved sectors. As organizations channel financial resources into building robust AI frameworks, ancillary industries are experiencing significant ripple effects that contribute extensively to economic expansion. There is an increasing convergence between tech-driven operations and traditional sectors due to AI’s pervasive influence. Establishing strong infrastructure does not solely benefit immediate industries but implicates broader economic growth patterns, fostering sustainable development.

Shaping Future Investment Opportunities

Considering the AI market’s trajectory, it becomes evident that there is potential for extensive future investment opportunities shaping global market dynamics. The active presence of exchange-traded funds tailored towards infrastructure supports emerging growth prospects, bridging investors with transformative technologies. This focus on infrastructure, such as the Artificial Intelligence Infrastructure ETF, positions investors to benefit from diversification in sectors pivotal to tech-driven advancements. As AI’s physical and digital spheres evolve symbiotically, the strategic balance in investment allows adaptability to changing market demands pioneering sustainable AI integration. Industry analysts continue to project significant influxes into thematic AI ETFs, evidencing favorable returns that propel further investment interest and engagement.

Looking Ahead: Sustaining Growth and Investment

In recent years, the field of artificial intelligence (AI) has undergone a substantial evolution reshaping the tech world and extending its influence far beyond its original sectors. This evolution has triggered an impressive increase in investment toward AI infrastructure as businesses across various industries seek to adapt and thrive in this era of innovation. AI is now recognized as a pivotal driver of global advancements, and organizations are realizing the importance of establishing solid foundations to support the growth and expansion of AI technologies. This growing awareness has led to substantial financial commitments aimed at developing critical infrastructures needed for AI. Key sectors, including data centers, energy providers, and materials manufacturers, are receiving increased attention and funding to ensure they can meet the demands of an AI-driven future. These investments are essential for bolstering the capabilities required for AI to integrate and enhance operations across industries, ultimately shaping the way businesses function globally.