In a definitive move that underscores the critical importance of real-time data in the age of artificial intelligence, IBM has announced a landmark agreement to acquire the data streaming pioneer Confluent Inc. for approximately $11 billion. This all-cash transaction, which values Confluent at $31 per share, represents a pivotal moment in IBM’s ongoing strategic transformation, aiming to fortify its capabilities in hybrid cloud and enterprise AI by directly addressing the insatiable demand for instantaneous data processing. The acquisition is not merely a financial transaction but a strategic integration designed to place IBM at the epicentre of the data-in-motion ecosystem, a foundational layer required for the sophisticated, high-speed analytical models that are redefining modern business operations and decision-making processes across every industry. This move signals a clear intent from the technology giant to own the infrastructure that will power the next wave of intelligent applications.

The Strategic Rationale for Data in Motion

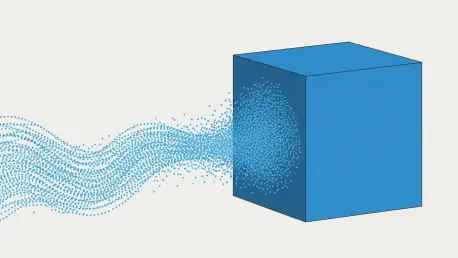

This acquisition is fundamentally rooted in IBM’s ambition to provide a comprehensive “smart data platform” for its enterprise clients, a solution designed to manage the relentless, high-velocity stream of information essential for today’s generative and agentic AI systems. These advanced AI models depend on a continuous, trusted flow of current data to function effectively, and Confluent’s technology provides the very backbone for this “data-in-motion.” IBM Chief Executive Arvind Krishna highlighted this objective, framing the deal as a way to “help clients move from insight to action instantly across complex hybrid environments.” This is not an isolated event but a continuation of a deliberate M&A strategy that has seen IBM make significant investments to bolster its core platforms. Following the landmark acquisitions of Red Hat in 2019 and HashiCorp in 2024, the purchase of Confluent further cements IBM’s commitment to building an end-to-end infrastructure that spans hybrid cloud, automation, security, and now, the critical real-time data layer for AI.

For Confluent, the merger offers a clear path to accelerated global growth by leveraging IBM’s extensive resources, sales channels, and established enterprise relationships. Confluent co-founder and CEO Jay Kreps emphasized that joining IBM will amplify the company’s strategic expansion on a global scale. This development arrives at a critical juncture for Confluent, which, despite its leadership in the Kafka ecosystem, had recently faced market headwinds, including disappointing quarterly results and a lowered future outlook. Reports had surfaced that the company was exploring a potential sale, making the acquisition by a stable, powerful entity like IBM a highly strategic outcome. The deal provides Confluent with the platform to embed its foundational technology deeper into the enterprise IT stack, ensuring its open-source-based platform becomes an even more integral part of the modern data architecture that powers real-time analytics, intelligent automation, and the next generation of AI-driven applications.

Reshaping the Competitive Landscape

From a strategic portfolio perspective, the acquisition directly addresses a significant vulnerability in IBM’s product lineup. According to analysis from industry experts like Gartner Inc. Senior Director Analyst Andrew Humphreys, IBM’s own Kafka and data streaming offerings had failed to gain the same level of market traction as its other successful products, such as IBM MQ. In fact, Confluent had been effectively “taking market share from IBM” in this crucial segment. By acquiring the undisputed market leader, IBM executes a powerful “buy over build” strategy. Instead of continuing to invest in its less successful homegrown alternatives, IBM instantly absorbs a best-in-class, enterprise-grade technology. This maneuver not only fills a critical product gap but also neutralizes a key competitor in one swift move, providing IBM with immediate credibility and a commanding position in the data streaming market, which is increasingly seen as non-negotiable for any serious enterprise AI contender.

This strategic purchase dramatically enhances IBM’s competitive posture against other enterprise software behemoths like Salesforce Inc. and Oracle Corp., which are also aggressively pursuing strategies centered on data governance and access as the foundation for their AI offerings. The integration of Confluent’s platform will enable “IBM to compete more effectively… as the platform to control and access data and feed AI,” according to analysts. The structure of an acquisition, as opposed to a mere partnership, is also crucial. It allows for a much deeper and more seamless integration of Confluent’s Kafka technology with IBM’s broader portfolio, including its watsonx AI platform, data fabric, and automation tools. This creates a more cohesive and powerful value proposition for customers. Furthermore, the deal provides IBM with access to Confluent’s formidable customer base of 6,500 enterprises, which notably includes 80% of the Fortune 100, unlocking a vast and immediate market for cross-selling its combined offerings.

A Forward-Looking Integration

The financial terms of the deal underscored the immense value IBM placed on securing this foundational technology. The $11 billion all-cash purchase at $31 per share represented a substantial 34% premium over Confluent’s recent closing stock price, a clear signal of IBM’s confidence in the long-term strategic value of the merger. IBM projected a positive financial outlook, anticipating the acquisition would be accretive to adjusted EBITDA within the first full year and would generate positive free cash flow by the second year after the transaction’s expected close in mid-2026. This acquisition was a multifaceted and decisive maneuver that provided IBM not only with leading technology but also a significant business advantage. By integrating Confluent, IBM successfully filled a critical product gap, neutralized a growing competitor, and gained access to a valuable new customer base, fundamentally reshaping its strategy for the AI era and solidifying its position as a central player in the future of enterprise data infrastructure.