The widespread declaration of a singular “AI bubble” has become a fixture in financial commentary, painting a dangerously simplistic picture of a market teetering on the brink of a catastrophic, unified collapse. While the parallels to past tech manias are undeniable, this monolithic view obscures the complex, layered ecosystem at play. The current artificial intelligence boom is not one massive bubble but a stratified system of three distinct bubbles, each with its own economic logic, risk profile, and, most importantly, its own expiration date. Understanding this sequential structure is critical for anyone looking to navigate the market correction that is already underway. This analysis deconstructs the AI landscape into its three core layers, revealing a cascade of bursts that are rationalizing the market in stages, starting with the most fragile and ending with the most resilient.

From Dot-com Dreams to AI Delirium

To understand the current AI frenzy, it is helpful to look back at the dot-com bubble of the late 1990s. That era was characterized by a euphoric, indiscriminate rush to fund any company with a “.com” in its name, leading to a spectacular crash that wiped out ventures built on hype rather than sound business models. Today, the rapid ascent of generative AI has ignited a similar gold rush, pouring unprecedented capital into a wide spectrum of companies. However, the underlying technology this time is far more transformative.

This distinction matters because it requires a more nuanced analysis than what was applied to the dot-com era. Instead of asking if a bubble exists, the more insightful question is which bubbles exist and how they are interconnected. The current market is a stratified system where different components carry vastly different levels of real, sustainable value. The capital flowing into the sector is not uniform in its risk or its expected return, making a layered deconstruction essential for an accurate market assessment.

The Three-Tiered AI Market: A Sequential Deconstruction

Bubble 1: The Ephemeral Wrappers Built on Borrowed Brains

The first and most fragile bubble consists of what are known as “wrapper” companies, and its bursting is the defining market event of this year. These startups built their entire business model by taking powerful foundation models from providers like OpenAI, wrapping them in a specialized user interface, and selling access as a niche tool—often for a monthly subscription. While companies like Jasper.ai demonstrated that this could be a shortcut to early revenue, their foundation was built on sand, and that foundation has now given way. Their value proposition was paper-thin and faced existential threats from every direction, which have now materialized.

The most significant danger, feature absorption, has proven to be their undoing. Tech giants like Microsoft and Google have simply incorporated the functionality of these wrappers directly into their existing platforms, making the standalone products obsolete overnight. Lacking proprietary technology, deep workflow integration, or any real customer lock-in, these companies were caught in a commoditization trap with zero switching costs. As the underlying AI models became more powerful and accessible, the thin layer of value these wrappers provided evaporated, setting the stage for the mass extinction event that is currently unfolding.

Bubble 2: The Foundation Models and the Trillion-Dollar Question

Occupying the middle ground are the foundation model companies themselves—the architects of the AI revolution like OpenAI, Anthropic, and Mistral. This layer is far more defensible than the wrappers, protected by deep moats of specialized talent, massive computational resources, and superior model performance. However, it is by no means immune to bubble dynamics. The valuations here are staggering, with investments approaching a trillion dollars against projected revenues that are a tiny fraction of that figure. This chasm between capital deployed and plausible earnings is a classic warning sign that investors are now taking seriously.

Further complicating the picture are circular investment flows, where a chipmaker funds a model provider who then uses that capital to buy the chipmaker’s products, creating an artificial echo chamber of demand. Survival in this layer will ultimately hinge not on model size but on engineering efficiency. As performance begins to converge, the winners will be those who can optimize inference to deliver answers faster and more cost-effectively at scale. A period of intense consolidation is now expected between the current year and 2028, a process that will leave only two or three dominant players standing.

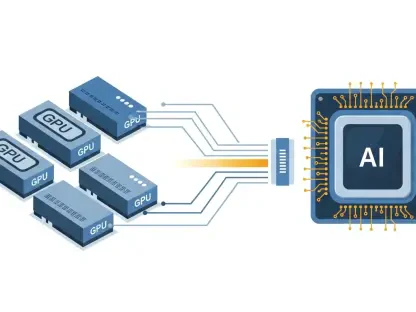

Bubble 3: The Infrastructure Bedrock, the Safest Bet of All

The third and final layer—the infrastructure that powers AI—is paradoxically the least bubbly, despite attracting over a trillion dollars in capital expenditure. This segment includes the makers of essential hardware like Nvidia’s GPUs, data center operators, and cloud service providers. The value here is durable and application-agnostic; the chips and data centers being built today will power AI innovation for years to come, regardless of which specific models or applications ultimately triumph.

This mirrors the dot-com era’s massive fiber-optic build-out, which seemed excessive at the time but later became the essential backbone for services like YouTube and Netflix. The robust and growing revenues from Nvidia’s data center division are not speculative hype but a reflection of real, strategic demand from companies making necessary long-term investments. While this layer may experience short-term cycles of overbuilding, its fundamental, long-term value is secure, as it forms the non-negotiable foundation for the entire AI economy.

The Coming Cascade: How the Market Correction Will Unfold

The bursting of these three bubbles is not a simultaneous event but a sequential, cascading correction that is already in motion. The process began at the top layer and is working its way down, with each phase triggering the next. The first domino to fall has been the mass failure of wrapper companies, as their unsustainable models buckled under the pressure of commoditization and feature absorption.

This initial collapse is sending a shockwave through the market, forcing a sober reevaluation of the entire AI ecosystem. The subsequent consolidation in the foundation model layer will be a direct consequence, as investors become more discerning and capital flows only to the most technically efficient and well-positioned players. Finally, this rationalization will clarify the true, sustainable demand for AI infrastructure, leading to a normalization of spending after a period of frantic overbuilding.

A Strategic Roadmap for Navigating the Shakeout

The key takeaway from this layered analysis is that while the AI revolution is real, the investment frenzy surrounding it is not uniform. The froth is concentrated at the application surface, while the most enduring value lies at the infrastructure core. For entrepreneurs and investors, this understanding provides a clear roadmap for survival and success. The primary risk for a startup was not starting as a wrapper, but remaining one.

To build a defensible business, founders must aggressively move to own the entire workflow, creating proprietary data and integrating so deeply into customer operations that switching becomes prohibitively difficult. For investors, the lesson is to look past the superficial hype and assess which layer of the AI stack a company truly occupies. The ultimate moat in the AI era will not be access to a particular model but a superior ability to acquire and retain customers through deep, defensible value.

Beyond the Hype: A Resilient Future

The AI market was not a single bubble but a series of interconnected ones set to pop in a predictable order. The impending correction was not to be feared as the end of AI but welcomed as a necessary and healthy rationalization. It stripped away the speculative excess, distinguished fleeting hype from foundational innovation, and revealed the companies that were building truly transformative technology. The shakeout proved challenging, but it ultimately strengthened the ecosystem, clearing the path for a more sustainable and impactful wave of AI-driven progress. The future belonged not to those who could simply wrap an API, but to those who built enduring platforms on the resilient infrastructure being laid today.