MindBridge, an AI-driven financial risk intelligence platform, recently announced significant enhancements to its MindBridge AI™ platform. These updates aim to address escalating financial risks and provide finance professionals and auditors with advanced tools for anomaly detection, compliance assurance, and effective risk management. As traditional risk management methods struggle to keep pace with increasing data volumes and evolving regulations, the need for continuous, comprehensive monitoring of financial transactions has become critical. MindBridge’s expanded features are designed to meet these challenges head-on.

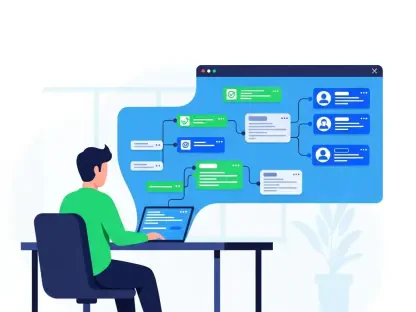

The platform now offers key capabilities for a robust response to modern financial risk management demands. The new Insights Dashboard, for example, introduces an intuitive interface that provides clear, actionable insights. This allows users to quickly identify and prioritize high-risk areas, streamlining the process for detecting anomalies and inefficiencies. Moreover, the Data Explorer tool enables a seamless transition from high-level insights to detailed data entries, thereby enhancing investigatory precision. This tool integrates with the Insights Dashboard to create a connected workflow, designed to accelerate risk detection and response times.

The Changing Landscape of Financial Risk Management

In an era where data is both abundant and essential, traditional oversight techniques such as sampling have proven inadequate. MindBridge’s enhancements signify a leap toward efficient, real-time risk management. The platform’s ecosystem of connected capabilities now includes patented data ingestion technology that simplifies the integration and processing of financial data from various sources. Supporting cloud connections, web APIs, and a Python interface, this technology facilitates seamless data ingestion.

Additionally, the platform integrates with popular analytics tools and data movement services. It works with Apache Spark, Databricks, and Jupyter Notebooks for advanced data processing, and with Azure Data Factory for scheduled and automated continuous data flows. This comprehensive support system ensures that the data remains accurate, timely, and ready for analysis, thereby enhancing the reliability and effectiveness of the risk management process.

Established in 2015 and headquartered in Ottawa, Canada, MindBridge has earned global recognition for its innovative approach to financial risk intelligence. By continuously analyzing vast amounts of financial transactional data, the platform enables companies to identify and manage risks from various perspectives, whether they are auditors, regulators, or bespoke financial controls. Trusted worldwide by finance professionals, MindBridge has analyzed over 135 billion financial transactions for risk. This impressive feat underscores the platform’s capability to handle large-scale data sets efficiently, making it a valuable tool in modern financial risk management.

The Benefits of Real-Time Insights

One of the most notable advancements in the updated MindBridge platform is the Insights Dashboard. This feature provides finance professionals and auditors with a user-friendly interface, offering clear and actionable insights. The high-risk areas can be quickly identified and prioritized, making the detection of anomalies and inefficiencies more straightforward and efficient. By improving the process of anomaly detection, the Insights Dashboard helps professionals make data-driven decisions faster, reducing the time and resources spent on manual investigations.

Moreover, the Data Explorer offers detailed data entries, allowing for enhanced investigatory precision. This tool is integrated with the Insights Dashboard, providing a seamless workflow to boost risk detection and response times. By offering a detailed view of the financial data, the Data Explorer complements the high-level insights provided by the Insights Dashboard. Together, these tools form a cohesive system that enhances the overall effectiveness of financial risk management.

MindBridge’s platform also supports multiple data sources and analytics tools, making it a versatile choice for various organizations. The incorporation of cloud connections, web APIs, and a Python interface facilitates the seamless ingestion and integration of financial data. Additionally, the platform’s compatibility with analytics tools like Apache Spark, Databricks, and Jupyter Notebooks enables advanced data processing capabilities. The integration with data movement services such as Azure Data Factory further enhances the platform’s ability to handle continuous data flows efficiently.

A Leap Toward Efficient Risk Management

MindBridge, an AI-powered financial risk intelligence platform, has unveiled major updates to its MindBridge AI™ platform at The MindBridge Conference. These enhancements are designed to tackle rising financial risks, equipping finance professionals and auditors with advanced tools for anomaly detection, compliance assurance, and effective risk management. As traditional methods lag behind due to growing data volumes and changing regulations, continuous and thorough monitoring of financial transactions is now essential. The expanded features of MindBridge are crafted to meet these modern challenges directly.

One notable addition is the Insights Dashboard, which offers an intuitive interface for clear, actionable insights. This helps users swiftly pinpoint and prioritize high-risk areas, streamlining the detection of anomalies and inefficiencies. Furthermore, the new Data Explorer tool facilitates detailed investigations, allowing users to move seamlessly from high-level insights to specific data entries. This tool works in tandem with the Insights Dashboard to create a cohesive workflow, thereby speeding up both risk detection and response times. These updates aim to empower financial professionals in an increasingly complex environment.