In a semiconductor industry grappling with fluctuating demand and intense competition, Veeco Instruments (NASDAVECO) has emerged as a standout performer in the second quarter of this year, showcasing its ability to navigate challenges. Despite facing a year-over-year revenue dip of 5.6%, dropping from last year’s figures to $166.1 million, the company not only exceeded its own projected range of $135–$165 million but also surpassed analyst expectations set at $151.21 million. This achievement highlights Veeco’s remarkable ability to adapt and thrive in a softening market, driven by a sharp focus on high-growth areas such as artificial intelligence (AI) and high-performance computing (HPC). As technology continues to evolve at a rapid pace, Veeco’s strategic positioning in enabling cutting-edge chip manufacturing positions it as a pivotal player. The company’s success in navigating industry challenges while capitalizing on emerging trends offers a compelling narrative for stakeholders looking to understand the dynamics of semiconductor innovation.

Financial Strength in a Volatile Market

Veeco’s performance in the recent quarter showcases an impressive level of financial resilience, even as the broader semiconductor market faces headwinds. With a non-GAAP gross margin standing at 42.6% and an operating margin of 13.9%, the company demonstrates a strong ability to maintain profitability under pressure. A substantial cash reserve of $355 million further bolsters its capacity to withstand economic fluctuations and invest in future growth. The guidance for the third quarter, projecting revenue between $150 and $170 million with gross margins expected to hover between 40% and 42%, reflects sustained confidence in operational stability. This financial discipline sets Veeco apart from many competitors struggling to balance costs and revenue in an unpredictable landscape, providing a solid foundation for navigating short-term challenges while keeping an eye on long-term objectives.

Beyond the raw numbers, Veeco’s financial health speaks to a broader strategy of efficiency and adaptability in resource allocation. The company’s non-GAAP net income of $21.5 million, translating to $0.36 per share, underscores a commitment to delivering value to shareholders even in a downturn. This performance is particularly noteworthy given the external pressures of supply chain disruptions and geopolitical uncertainties impacting the industry. By maintaining a strong balance sheet, Veeco ensures it has the flexibility to pivot as market conditions evolve, whether that means ramping up production or doubling down on research initiatives. Such fiscal prudence not only mitigates risks but also positions the company to seize opportunities as demand for advanced semiconductor technologies continues to grow, particularly in key application areas driving the digital economy.

Harnessing AI and HPC for Market Dominance

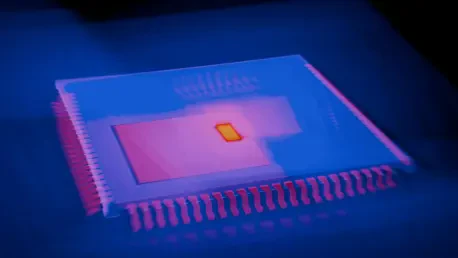

Veeco’s strategic alignment with the booming sectors of AI and HPC marks a significant driver behind its recent success. The company’s portfolio, which includes advanced tools for gate-all-around transistors, 3D packaging, and high-numerical aperture extreme ultraviolet lithography, directly addresses the semiconductor industry’s shift toward increasingly complex manufacturing processes. As the generative AI chip market is projected to surpass $150 billion this year, Veeco’s specialized equipment is well-positioned to meet the rising demand for high-performance solutions. This focus on cutting-edge technology not only enhances the company’s relevance but also cements its role as an enabler of next-generation innovations that power everything from data centers to consumer electronics in an increasingly connected world.

The significance of Veeco’s contributions to AI and HPC extends beyond mere market participation to a deeper integration within the industry’s transformative trends. Approximately 75% of its revenue is derived from the semiconductor segment, which supports critical advancements like heterogeneous integration in AI accelerators and high-bandwidth memory solutions. These technologies are vital for achieving greater chip density and energy efficiency, both of which are paramount in meeting the computational demands of modern applications. By providing mission-critical tools for sub-2nm node production, Veeco ensures that its clients remain at the forefront of innovation. This alignment with megatrends not only drives current revenue but also sets the stage for sustained growth as the total addressable market for AI accelerator chips is expected to reach $500 billion by 2028, offering substantial opportunities for expansion.

Innovation and Regional Strength as Growth Catalysts

Technological leadership remains a cornerstone of Veeco’s market strategy, exemplified by innovations such as the WaferStorm® systems tailored for advanced packaging. These systems have already garnered $50 million in orders last year, signaling strong demand for Veeco’s solutions in enabling sophisticated chip designs. Furthermore, the company’s robust presence in key innovation hubs like South Korea and Taiwan, which contributed 59% of its Q2 revenue, underscores its global reach and regional influence. Ongoing research and development efforts, including cutting-edge solvent technologies and evaluations with top-tier semiconductor firms, ensure that Veeco remains ahead of the curve in addressing the industry’s evolving needs, reinforcing its competitive edge in a crowded field.

Geographic diversification amplifies Veeco’s ability to capitalize on market opportunities while mitigating localized risks. The strong foothold in the Asia-Pacific region, excluding China, positions the company to benefit from the rapid technological advancements and manufacturing expansions occurring in these areas. Collaborations with leading industry players further enhance Veeco’s capacity to deliver tailored solutions that meet specific client demands, from ramping up production capacities to pioneering new fabrication techniques. This regional strength, combined with a forward-thinking R&D pipeline, creates a virtuous cycle of innovation and market penetration. As semiconductor manufacturing continues to grow in complexity, Veeco’s ability to adapt and innovate ensures it remains a trusted partner for firms pushing the boundaries of what’s possible in chip technology.

Tackling Challenges Through Strategic Diversification

Despite a promising outlook, Veeco faces notable challenges that could impact its trajectory, including regulatory constraints in China, which accounts for 17% of its revenue, alongside fierce competition in specialized markets like laser annealing and ion beam deposition. Potential margin compression due to a shift toward advanced packaging systems also looms as a concern. However, the company actively counters these risks through a diversified geographic presence that reduces dependence on any single market. By focusing on high-value tools and maintaining robust relationships with tier-1 customers, Veeco builds a buffer against short-term volatilities, ensuring greater stability in an industry often subject to rapid shifts and unpredictable disruptions.

The proactive measures taken by Veeco to address these challenges highlight a nuanced approach to risk management. Diversification across regions and product lines allows the company to balance exposure to geopolitical tensions and competitive pressures, while a strong emphasis on customer partnerships provides critical long-term visibility into demand trends. This strategic foresight is essential in a sector where technological obsolescence can occur swiftly, and market dynamics can shift overnight. By prioritizing high-margin, specialized equipment, Veeco not only safeguards its profitability but also positions itself as a leader in niche areas of semiconductor manufacturing. Such efforts underscore a resilience that is likely to serve the company well as it navigates the complexities of a global market, maintaining relevance amid evolving industry standards.

Investment Appeal in a Booming Sector

From an investment perspective, Veeco presents a high-beta opportunity closely tied to the explosive growth of AI and HPC technologies. With a forward price-to-earnings ratio of 15x, notably lower than many peers in the semiconductor equipment space, the company appears undervalued, offering a potentially attractive entry point for those with a long-term horizon. This valuation suggests room for significant appreciation over the next three to five years, particularly as demand for advanced manufacturing tools continues to surge. Investors willing to tolerate short-term market fluctuations may find Veeco’s strategic focus on high-growth areas a compelling reason to consider it as part of a diversified tech portfolio.

The broader investment case for Veeco is further strengthened by its pivotal role in enabling critical industry transitions, such as the move to sub-2nm nodes and the increasing complexity of AI workloads. These trends are not fleeting but represent fundamental shifts in how technology is developed and deployed, creating a sustained demand for the company’s offerings. Financial stability, evidenced by strong margins and cash reserves, adds another layer of confidence for potential stakeholders. While risks remain, the combination of technological leadership and an attractive valuation makes Veeco a noteworthy contender in the semiconductor space. For those looking to gain exposure to the AI-driven tech revolution, keeping an eye on Veeco’s progress could yield insights into broader industry movements and investment opportunities.